A New Smyrna Beach woman claims her excellent credit score was ruined by a total stranger.

It's a little known but common credit bureau mistake that can wreck your finances.

Action 9 consumer investigator Todd Ulrich found the credit bureaus mix up files with similar names and addresses. Restoring a consumer’s good credit could take years.

Kayla Murchison picked out her first new car and signed the contract. But her purchase didn’t go as planned.

“I thought my entire life was ruined right at that millisecond,” Murchison said.

Her new car loan was rejected because of someone else's bad credit.

Murchison had an excellent credit score of 720. But the finance manager at the dealership told her she had a bad score of 538.

“It was shocking. My heart dropped,” Murchison said.

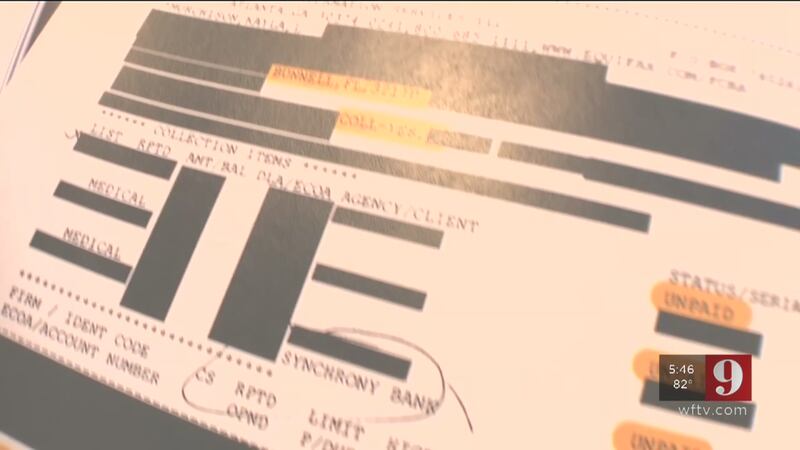

The real stunner came when she checked her report at all three credit bureaus. Her file included a total stranger's bad credit entries, which included delinquencies and collections.

“I could not believe what I was looking at,” Murchison said.

It's called a merged file. When credit bureaus don't want to miss anything, they cast a very wide net. That's how strangers with similar names, ages, and social security numbers, end up in a consumer’s credit file.

Murchison’s report includes a woman living in Bunnell.

“I had never lived in Bunnell, ever in my life,” Murchison said.

But the woman, whose name we're not mentioning, apparently is close enough for the credit bureaus. Murchison and the stranger have the same first name. Their social security numbers are just one digit off. They were born in the same month and year and they both live near Daytona Beach.

“It takes less than you imagine for those two files to be mixed,” said attorney Jared Lee.

He represents Murchison in a lawsuit filed against Equifax, Trans Union and Experian. The lawsuit claims the bureaus violated the Fair Credit Reporting Act by merging her file then failing to correct it.

“It put her life on hold,” Lee said.

Murchison said the credit bureaus ignored her complaints. “I wanted to rip my hair out every single day. It was impossible to fix yourself.”

Her case is extreme but not uncommon. About one in 20 credit score complaints involve merged files because banks don't want credit bureaus missing anything.

“They would rather be over-inclusive and more complete than accurate,” Lee said.

Murchison wants her life back.

“If it's close, it's good enough?” Ulrich asked.

“I was shocked,” Murchison replied.

All three credit bureaus told Action 9 they can't comment on lawsuits.

Transunion said it tries to resolve mistakes within two weeks.

The best defense for consumers is to review credit reports at least once a year and to dispute mistakes right away.

TransUnion response:

We understand that inaccurate information can affect a consumer’s credit score and may indicate fraudulent activity, and we take the reporting of inaccuracies very seriously. Incorrect information can appear on a credit report due to factors like misread handwriting on application forms, data entry errors, or confusion between consumers with similar personal information.

If a consumer identifies potential errors, it's best to dispute them as soon as they are spotted. The fastest and easiest way to resolve an inaccuracy on a TransUnion credit report is through our online Credit Report Dispute portal. Investigations are often concluded within two weeks of the date a request is received, however we recommend allowing up to 30-45 days for the dispute process.

In addition, keeping a regular and close eye on credit reports is the best way to identity potential errors that could be impacting an overall score. Every American consumer is entitled to review a free credit report once every 12 months from the three national Credit Reporting Agencies — Equifax, Experian and TransUnion. A consumer can click here to access his or her report today.

Cox Media Group