Truebill is a service that wants to help you save money on your monthly bills. In return, it wants a cut of the money it is putting back in your pocket.

On the surface, that seems like a reasonable trade off. But, like many things in life, this process isn’t as simple as it seems on the surface. There are trust hurdles and potential pitfalls to understand prior to putting Truebill to work on your finances.

Many Clark readers may equate this platform to Trim, which is another financial app that attempts to lower bills in exchange for a cut of the savings.

We’ll address the similarities and differences between the two in this article. We’ll also fill you in on the basics of how Truebill works, look at some safety concerns and also take a look at Better Business Bureau reviews.

Understanding How Truebill Works

Let’s start by developing a clear understanding of what Truebill is trying to accomplish, using its own words: It wants to “optimize your spending, manage subscriptions, lower your bills, and stay on top of your financial life.”

How could it possibly do all of those things? I signed up for an account to take a look around and find out.

It feels like you can break this service down into four categories, for the sake of understanding it: Lowering Your Bills, Managing Subscriptions, Seeking Refunds and Premium Services.

1. Lowering Your Bills

You’ll probably notice that Truebill advertises itself as a free service during the signup process. I guess that depends on how you view it. It’s true that there is no upfront fee for attempting to lower your bills, but you certainly aren’t getting away with the savings without compensating the business.

For every dollar saved by the use of Truebill, the company wants 40% as a “savings fee.” That fee is charged once the savings are secured, and it applies to one year’s worth of savings at one time. So, if Truebill saves you $500 annually on your bill, expect them to charge you $200. If Truebill is unable to find savings, you are not charged anything.

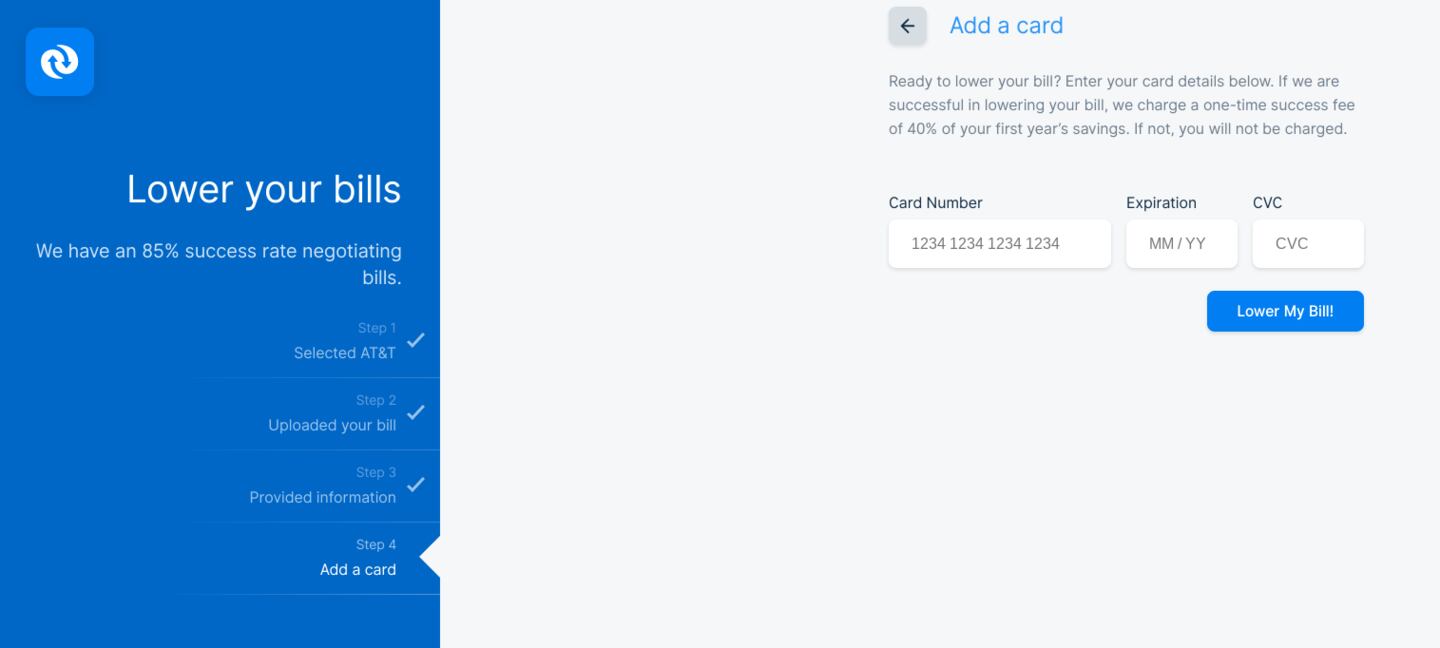

When you sign up for an account, one of the first things Truebill will do is prompt you to enter some of your monthly bills into their database through a four-step process.

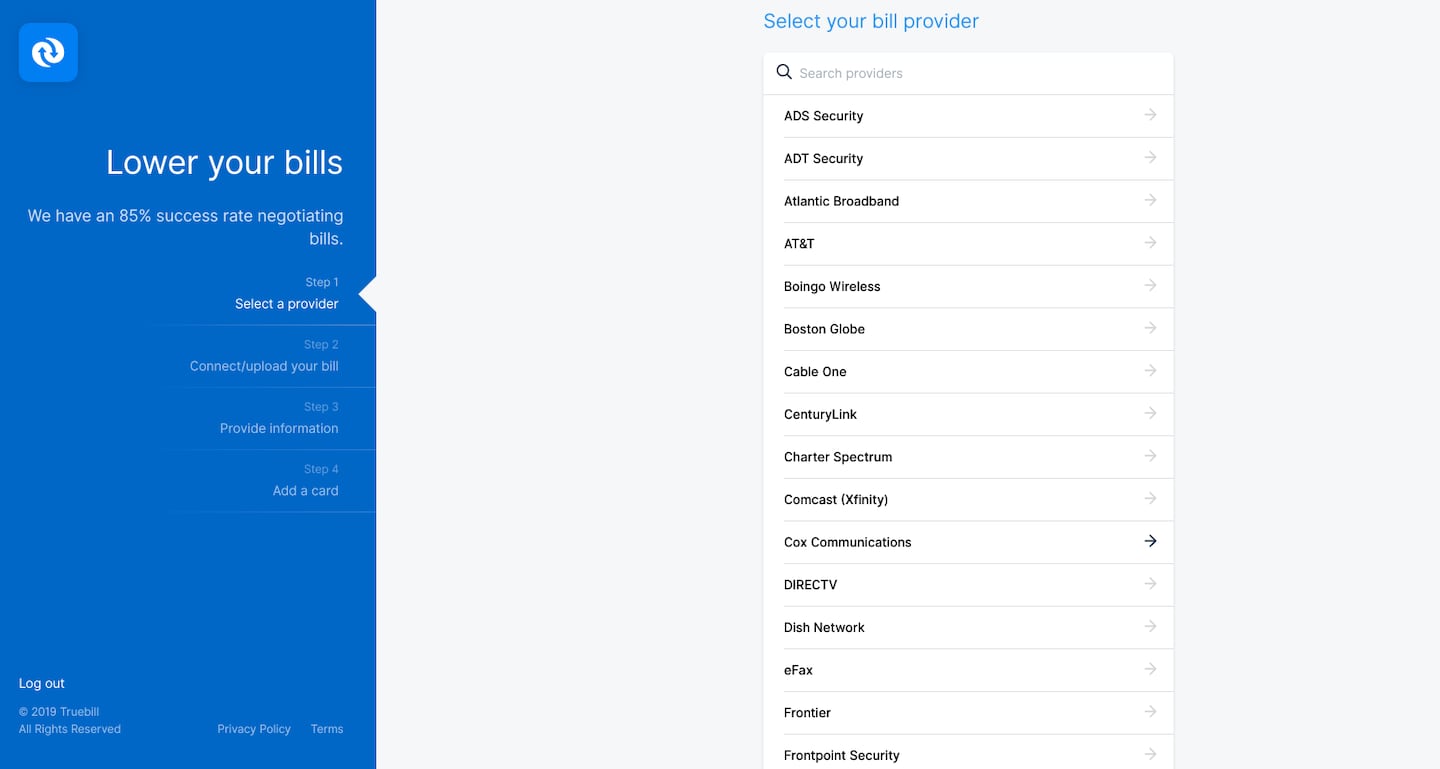

Step 1: Search For The Bill Provider

The list is actually pretty comprehensive. As you can see from the screen grab above, mainstream companies such as AT&T, Charter, Comcast and DirecTV are eligible for a price check by Truebill. The company touts a 85% success rate in negotiating bills.

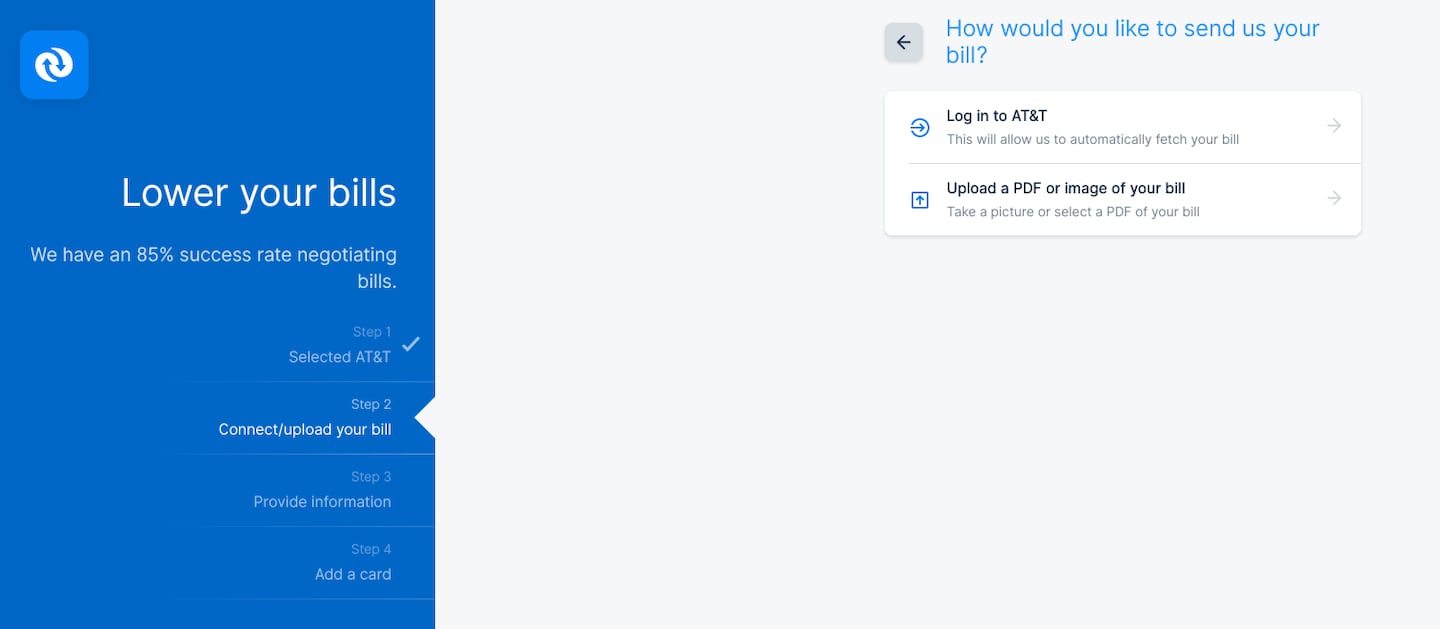

Step 2: Give Truebill Access To Your Monthly Billing Statements

This step may be where some of you start to get a little bit queasy when it comes to online security. There are two options: Either log into to your online billing account through to connect it to Truebill, or you can manually upload a PDF or image of the bill instead.

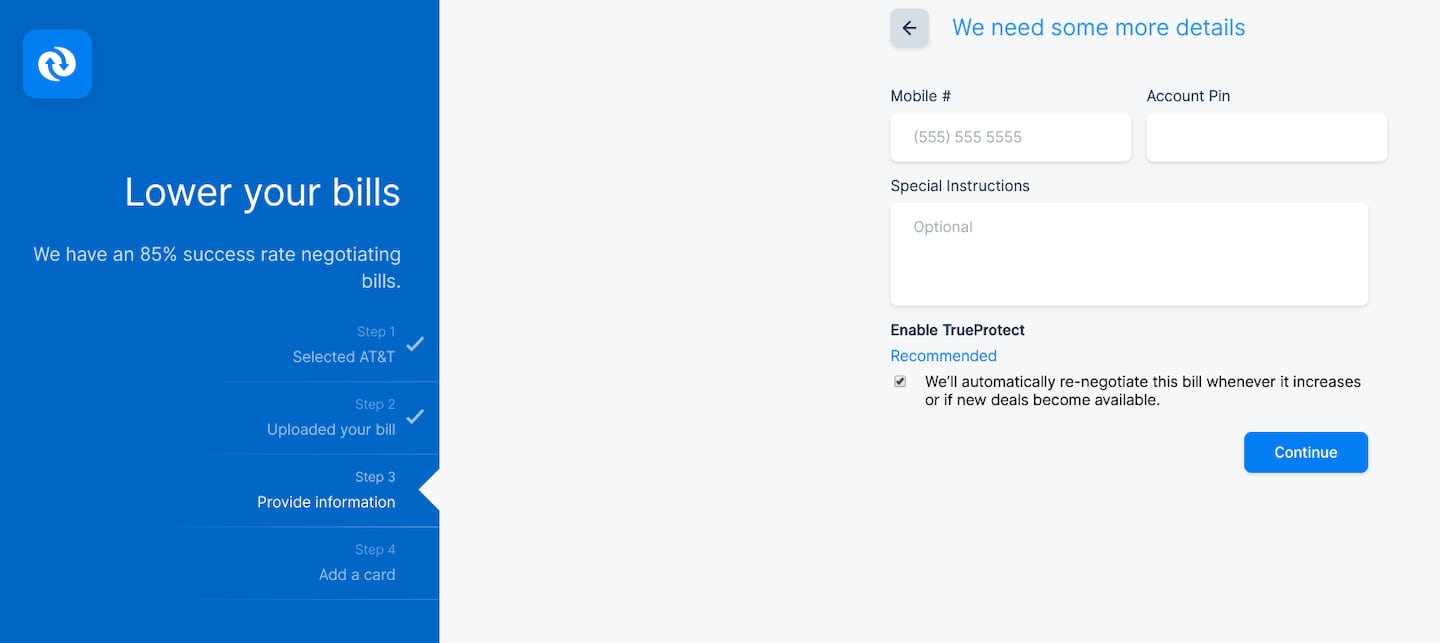

Step 3: Provide Contact Information And Enable ‘TrueProtect’

Providing a contact number is simple enough, but the real thing to pay attention to on this screen is opting this bill into the TrueProtect program. If you choose this option, you’re allowing Truebill to negotiate a better price on this bill if new deals come available.

As you’ll find out if you keep reading in our Better Business Bureau section of this review, it appears some users have had complaints about Truebill changing particulars on things like cell phone plans or cable packages for the sake of saving money.

That could be troublesome if it eliminates channels or features you felt were worth the extra money. And they’re going to hit you with their 40% savings fee upfront because they will have delivered on the promise to lower the bill.

Step 4: Give Truebill Authority To Charge Your Credit Card

Before they negotiate anything, Truebill is going to make sure it has a way to claim its 40% from you. The company only charges you if it is successful in lowering your bill, but it appears likely that they could claim their one-time savings fee from your card well before you see the gradual benefits of a reduced monthly bill.

2. Managing Subscriptions and Recurring Bills

After you’ve set up some bills for Truebill to analyze, then next service it is going to pitch you is the ability to manage monthly subscriptions.

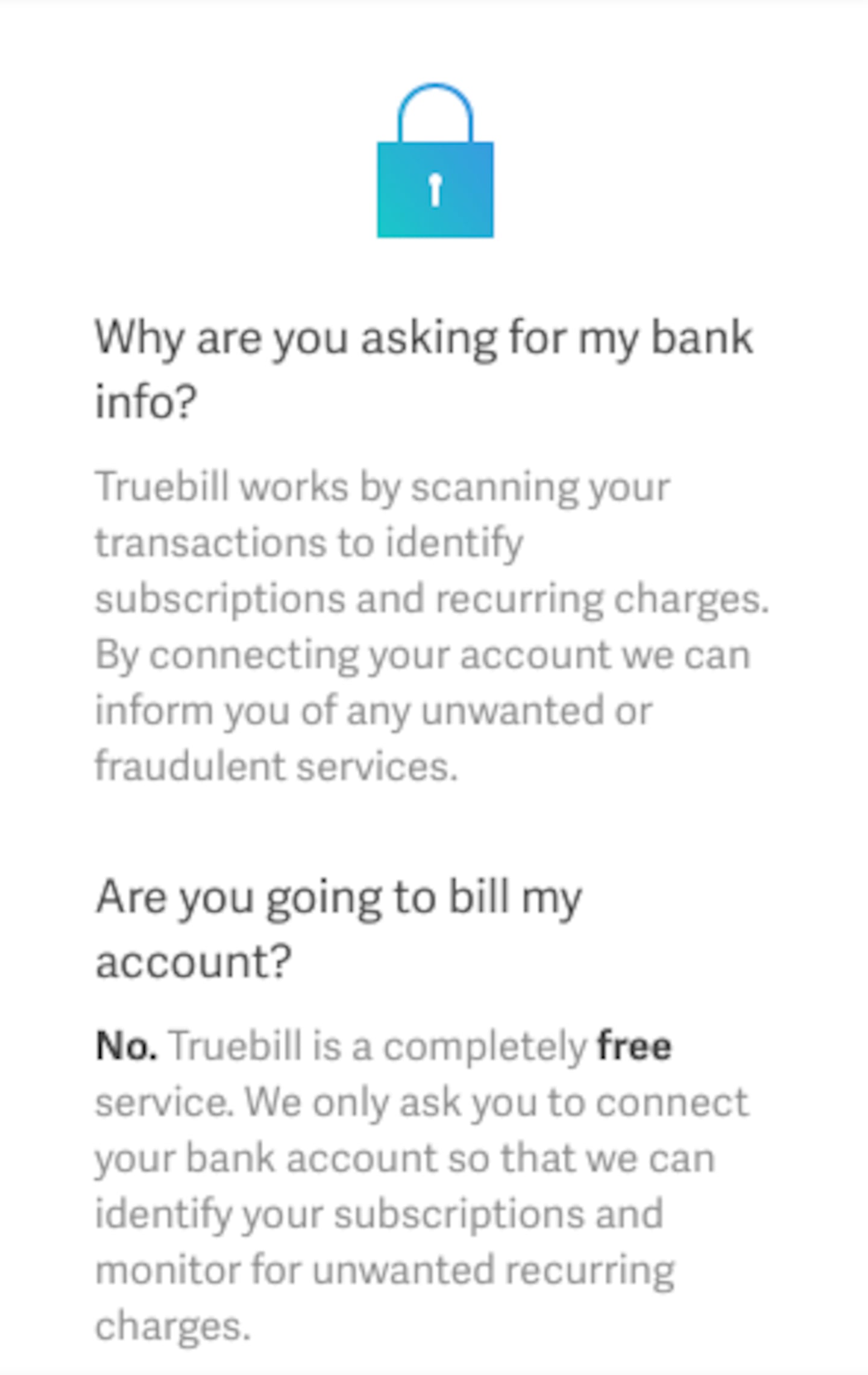

Truebill wants to be able to monitor these through either a bank or credit card statement. It gives you the option to add your preferred account via this dashboard screen:

Pay special attention to the disclaimer on this screen, which offers you an explanation of why Truebill wants access to the bank account. It also reiterates that it will not bill the account in question. Remember, they already have a credit card on file to charge if they claim a 40% savings fee.

A list of the subscriptions that Truebill is able to monitor on your statements is available here.

The theory is that Truebill will be able to pinpoint all of the recurring monthly charges you have on the provided account and then help you eliminate unwanted fees. You are able to remove these subscriptions on your own independent of the app, or you can sign up for Truebill’s premium service and their concierge team will cancel them for you. The premium service plans start at $4.99 per month.

3. Seeking Refunds For Fees And Outages

Truebill offers the service of sending a letter to banks in order to request refunds on overdraft or late fees on connected accounts. This process is initiated through the dashboard after you set your account up. It is worth noting that not all banks will allow Truebill to do this on your behalf and you may be stuck doing most of the legwork should a fee situation occur.

Truebill also monitors outages on things like your cable, internet and phone providers and will seek out a potential refund on your behalf. The 40% savings fee will apply to these findings, should they be successful. This one seems like a pretty nice perk, as sometimes you can be unaware an outage even occurred if you’re away from home.

4. Premium Services

In addition to lowering bills and managing subscriptions, Truebill also has some tools that may be helpful in making sound financial decisions with your monthly budget. However, many of those tools fall under the premium subscription options, which is offered at $4.99 monthly or $35.99 annually.

Truebill says premium subscription offerings include:

- Balance Syncing

- Premium Chat

- Cancellations Concierge

- Custom Categories

- Unlimited Budgets

- Smart Savings Plans

A subscription renews automatically, but can be canceled at any time.

While all these are nice offerings that could help you make smart decisions, it’s worth noting that services that monitor spending habits and budgets may already be offered by your bank or credit card issuer through their user interface. In other words, don’t pay Truebill for something you may already be getting elsewhere for free.

Is Truebill Safe to Use?

Any time a financial app asks for access to personal online financial records, you’re not wrong to be skeptical. It should immediately raise a red flag and you should proceed with caution.

Truebill understands that potential users are going to be skeptical of the security risks involved with the service. One of the main tabs on its website, aptly titled "Security", is an attempt to put your mind at ease about virtually handing over the keys to your accounts.

Here are some key points to consider from their security disclosure:

- Bank-level 256-bit encryption is in use for your data

- Truebill uses the Plaid service to connect with financial institutions

- Because of Plaid, you should not be asked to give banking credentials to Truebill

- Truebill says that it does not sell your data to third parties

- Truebill hosts its data on Amazon Web Services, which also stores sensitive data for the Department of Defense (among others)

So is it safe? It does seem on par with current industry security standards. However, only you can make the determination on whether these measures are enough to trust Truebill with your data.

Truebill vs. Trim: Differences in Competing Services

For most users, Truebill and rival financial app Trim are pretty easy to confuse. Both set out to tackle many of the same things: lowering monthly bills, managing subscriptions and detecting potential savings. Both have phone apps on Android and iOS, and both offer their services with more than 15,000 financial institutions. The similarities even extend to their names beginning with the same two letters.

But there are some distinctions we can make for the sake of comparison shopping.

The most glaring difference is the percentage each company charges for finding savings. Truebill charges 40%, while Trim is a bit lower at 33%.

Some secondary differences include:

- Trim will cancel subscriptions for free, but Truebill requires a premium subscription

- Trim offers a debt payoff program that runs $10 per month

- Truebill has free iOS and Android apps

How The Better Business Bureau (BBB) Rates Truebill

It feels like we should tag this portion of the review with a disclaimer: “The following is not for the faint of heart.”

Truebill's Better Business Bureau profile has red flags abound. Truebill is not accredited by the Better Business Bureau, and probably for good reason. It has an "F" rating, which means the business scored somewhere between 0 and 59.99 on the BBB grading scale. Just like in school, an F is the worst score possible.

Better Business Bureau indicates there are three key reasons for the failing grade:

- Failure to respond to 1 complaint(s) filed against business

- 20 complaint(s) filed against business

- Length of time business has been operating

The customer reviews of Truebill are not any better. At the time of this writing, the company had a one-star rating (out of five).

I read through the 20 complaints and was surprised to see 19 of them were filed within the last 12 months. There are some nightmare scenarios, with details ranging from complaints about Truebill claiming a 40% share of an internet bill savings that a customer negotiated themselves over the phone with their provider to Truebill renegotiating a cable/internet/phone bundle to lower costs that resulted in changing a cell phone plan without requesting permission.

It is worth noting that satisfied users often don’t report their experiences to the BBB, but there are enough negative reviews here to make you uncomfortable.

Final Thoughts: Is Truebill Worth It?

In spite of the negative reviews above, Truebill has the potential to help some consumers. Let’s take a quick look at some pros and cons for Truebill to see if it might be the right fit for you:

Truebill: Pros and Cons

|

|

| Pros | Cons |

| Catches service outages | Takes 40% of savings |

| Monitors subscription renewals | Requires access to sensitive personal information |

| No subscription fee for basic service | Has negative reviews on Better Business Bureau |

Bottom line: If you're someone who is on top of your budget and spending each month, Truebill may not be for you. However, if you are too busy to monitor things like auto-renewing subscriptions or service outages, the free service could be worth it. After all, 60% of uncovered savings is better than 100% of a missed savings opportunity.

Have you used the Truebill service? Let us know about your experience in the comments below!

The post Truebill Review: 4 Things To Know Before Signing Up appeared first on Clark Howard.

Clark.com